omaha nebraska sales tax rate 2020

The Nebraska state sales and use tax rate is 55 055. 2020 rates included for use while.

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

The latest sales tax rates for cities in Nebraska NE state.

. The latest sales tax rate for Omaha NE. The december 2020 total local sales tax rate was also 7000. Federal excise tax rates on beer wine and liquor are as follows.

You can print a 7 sales tax table here. Omaha has parts of it located within Douglas County. Omaha NE Copperfields Homes for Sale from.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. The minimum combined 2022 sales tax rate for Omaha Nebraska is. 2020 rates included for use while preparing your income tax deduction.

Omaha Nebraska Sales Tax Rate 2020. Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. This rate includes any state county city and local sales taxes.

Omaha Nebraska Sales Tax Rate 2020. Groceries are exempt from the Nebraska sales tax. Registration Fees and Taxes.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. What is the sales tax rate in Omaha Nebraska. The december 2020 total local sales tax rate was also 7000.

The average cumulative sales tax rate in Omaha Nebraska is 686. The minimum combined 2022 sales tax rate for omaha nebraska is. Driver and Vehicle Records.

Nebraska Income Tax Rate 2020 - 2021. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax.

Notification to permitholders of changes in local sales and use tax rates effective october 1 2022 updated 06032022 effective. 2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

6332 Nebraska has state sales tax of 55 and allows local. The minimum combined 2022 sales tax rate. 107 - 340 per gallon or 021 - 067 per 750ml bottle.

Omaha Nebraska Sales Tax Rate 2020. 1800 per 31-gallon barrel or 005 per 12-oz can. The latest sales tax rate for Omaha NE.

Nebraska Income Tax Rate 2020 - 2021. Nebraska Income Tax Rate 2020 - 2021. County and city taxes.

This includes the rates on the state county city and special levels. Counties and cities can charge an. The Ord Sales Tax is collected by the.

2020 rates included for use while preparing your income tax deduction. There is no applicable county tax or special tax. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

This is the total of state county and city sales tax rates. Sales Tax Calculator.

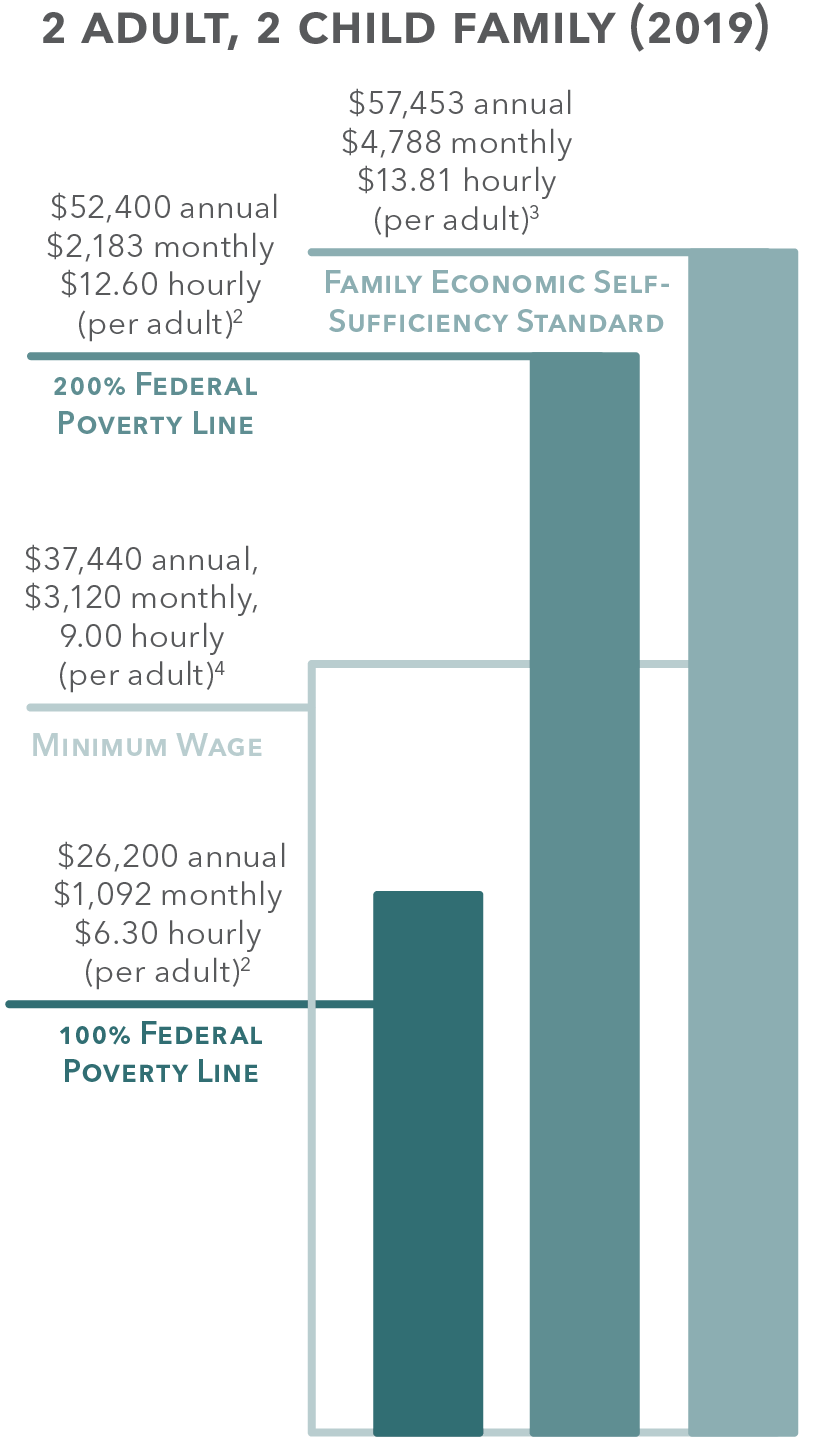

Economic Stability 2020 Kids Count Nebraska

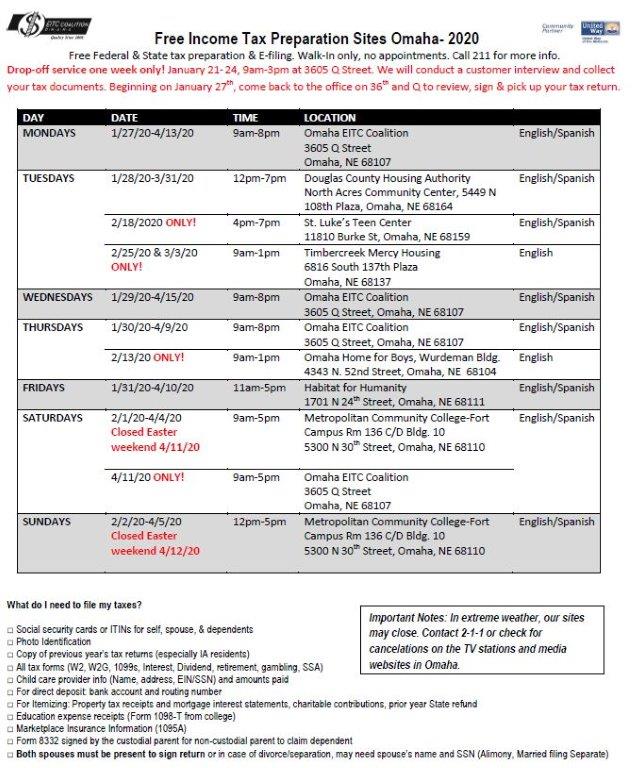

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

Moving To Omaha Nebraska The Truth About Living Here

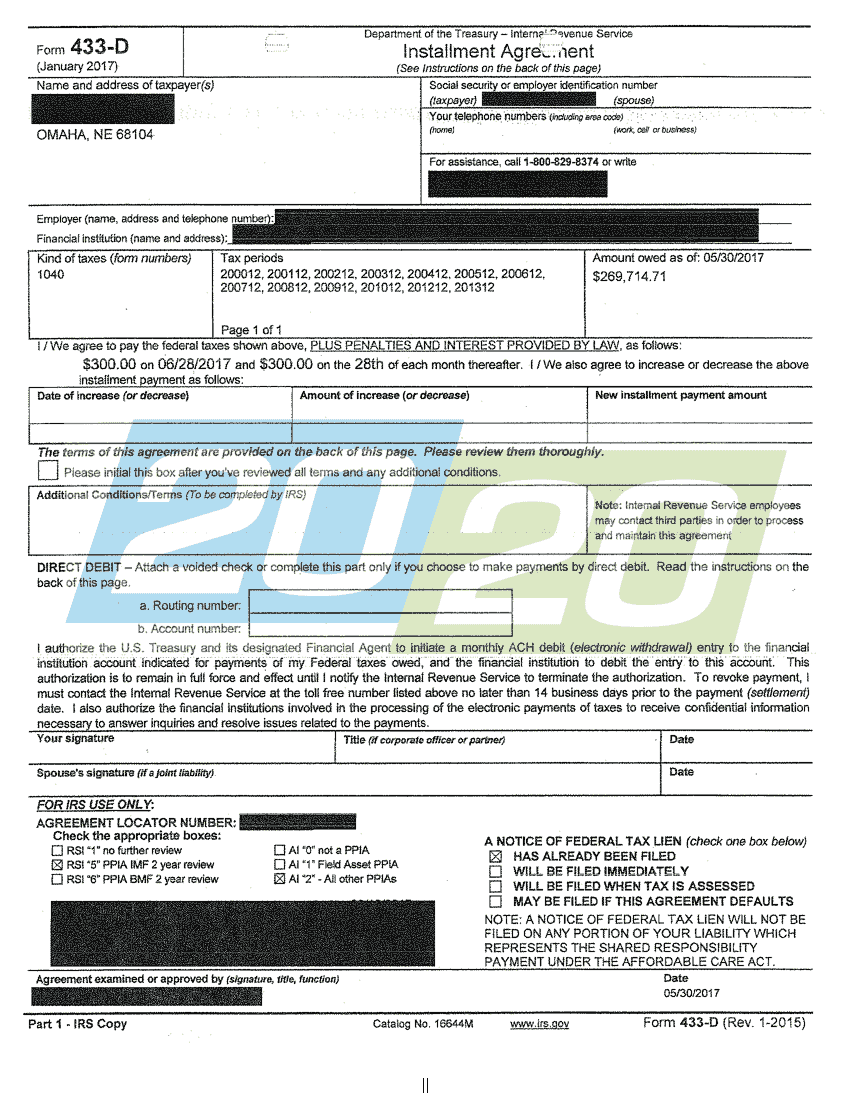

Fixed Tax Issues In Nebraska 20 20 Tax Resolution

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Sales Taxes In The United States Wikipedia

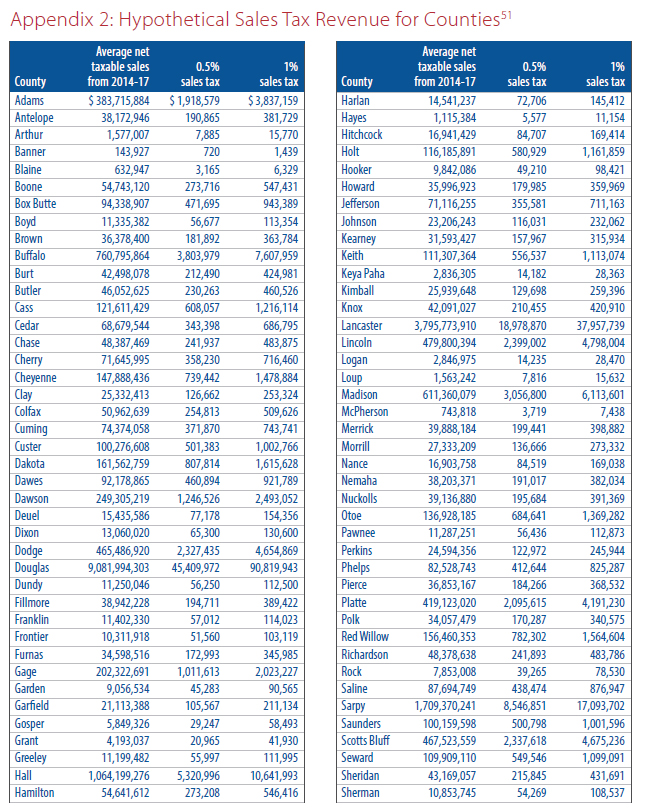

A Twenty First Century Tax Code For Nebraska Tax Foundation

Major Bills On Corrections Taxes Headed For Debate Wednesday Nebraska Examiner

Nebraska Sales Tax Small Business Guide Truic

How High Are Cell Phone Taxes In Your State Tax Foundation

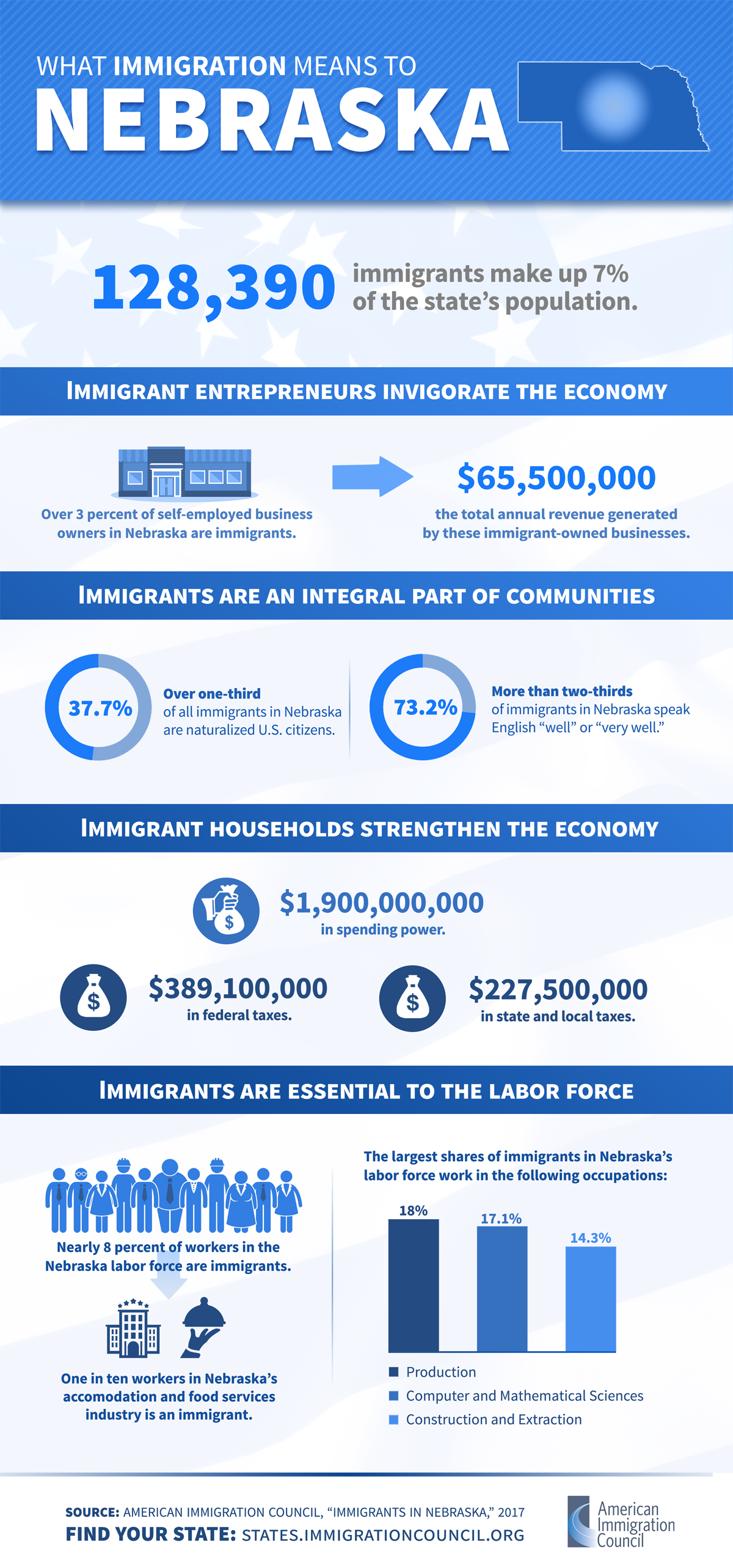

Immigrants In Nebraska American Immigration Council

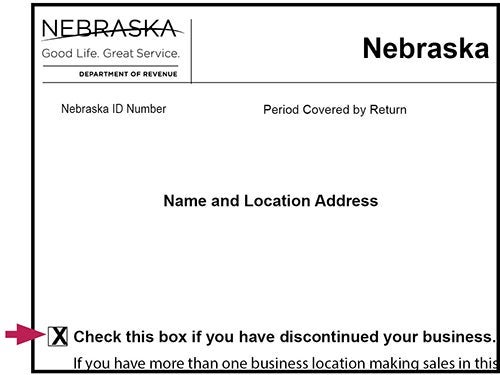

Closing Your Business In Nebraska Nebraska Department Of Revenue

Nebraska State Tax Things To Know Credit Karma

Historical Nebraska Tax Policy Information Ballotpedia

International Tax Accountant Omaha International Tax Cpas Ne

Nebraska State Tax Software Preparation And E File On Freetaxusa